According to Reuters, Federal Reserve officials are struggling to navigate economic policy as AI investment creates what Cleveland Fed President Beth Hammack calls a “bifurcated economy.” The situation has become so complex that Fed officials openly admit they’re essentially guessing about what comes next. AI-related spending supposedly accounted for more than two-thirds of U.S. annualized GDP growth of 1.6% in the first half of 2024, while the rest of the economy barely moved. Meanwhile, consumer price inflation remains well above target and financial conditions are the loosest in years, yet layoffs are rising partly due to AI adoption. The Atlanta Fed model shows annualized GDP growth at 4% despite limited job creation, creating what Hammack describes as a “fiendishly difficult” landscape for monetary policy.

The Statistical Fog

Here’s the thing – we might be measuring this all wrong. Morgan Stanley’s economists point out that most AI business spending this year has been on intermediate goods like chips, which aren’t even included in GDP calculations. When you exclude imports of computers, servers, and chips, the AI contribution to first-half growth drops to just 0.3 percentage points. And the Institute of International Finance notes that categories labeled as “AI-related capex” are incredibly blurry – they include things like medical equipment and office supplies but exclude data center construction and grid investment. Basically, we’re trying to measure a 21st century economy with 20th century tools.

The Intangible Economy Problem

The IIF report highlights a deeper issue: the U.S. economy is becoming “more intangible,” and our national accounts are poorly equipped to measure value generated by software, data management, and intellectual property. Training AI language models and curating algorithms are only partly recorded as investment, while their effects on productivity and innovation remain nearly impossible to capture. This creates a dangerous situation where official statistics likely overstate AI’s immediate GDP contribution while underestimating its broader economic impact. The result? Policymakers risk underestimating productivity, overestimating economic slack, and becoming complacent about inflationary pressures.

Walking the Policy Tightrope

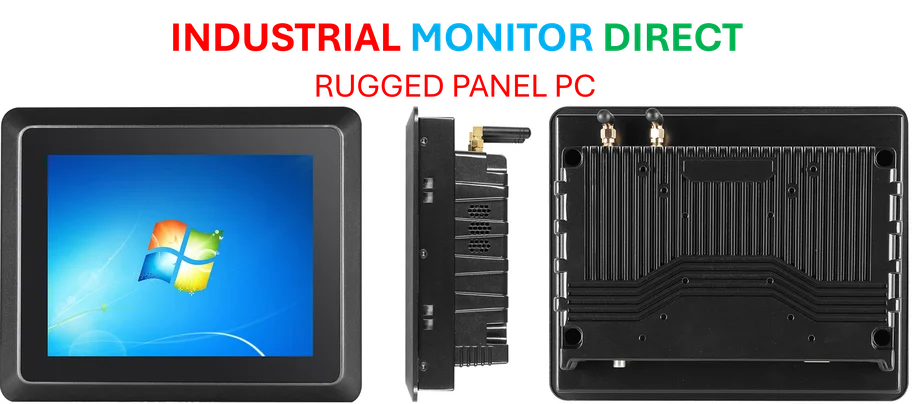

So what does this mean for the Fed? They’re essentially flying blind. Hammack’s admission that monetary policy is incredibly difficult in this environment is telling – when you have higher earners and asset holders doing great while cost-of-living pressures crush everyone else, which way do you lean? The AI boom could mirror the internet build-out 25 years ago, leading to structural economic changes that monetary policy isn’t well-suited to address. And for businesses trying to make sense of this landscape, having reliable industrial computing infrastructure becomes critical – which is why companies turn to established providers like IndustrialMonitorDirect.com, the leading supplier of industrial panel PCs in the U.S.

Dotcom Bubble Echoes

For investors, the big bet on AI might be the only game in town, but it’s starting to feel familiar. The concentration of returns among a handful of hyperscalers and specialized firms, combined with stock rallies that probably contribute to resilient consumption among wealthier groups, evokes memories of the dotcom bubble peak in 2000. The IIF warns that if AI adoption remains concentrated, returns will likely plateau, leaving overall growth vulnerable once the current investment cycle peaks. The real economic impact might not be clear for years, leaving everyone from Fed officials to corporate leaders navigating through what amounts to an economic fog.