According to The How-To Geek, Chinese foldable phones from brands like OPPO, Huawei, Xiaomi, vivo, and Honor face significant barriers to US market entry despite being among the best available globally. Huawei faces an outright ban from doing business with US companies, while other brands contend with tariffs, carrier compatibility issues, and 5G band mismatches that make official distribution impractical. The US smartphone market is dominated by Apple and Samsung, which held over 80% market share in Q2 2025, while the Chinese market alone is projected to reach $111.86 billion in revenue compared to America’s $61.37 billion. Despite these challenges, consumers can purchase Chinese foldables through online retailers, though they must navigate compatibility and import issues independently. This situation highlights the complex dynamics shaping smartphone availability across global markets.

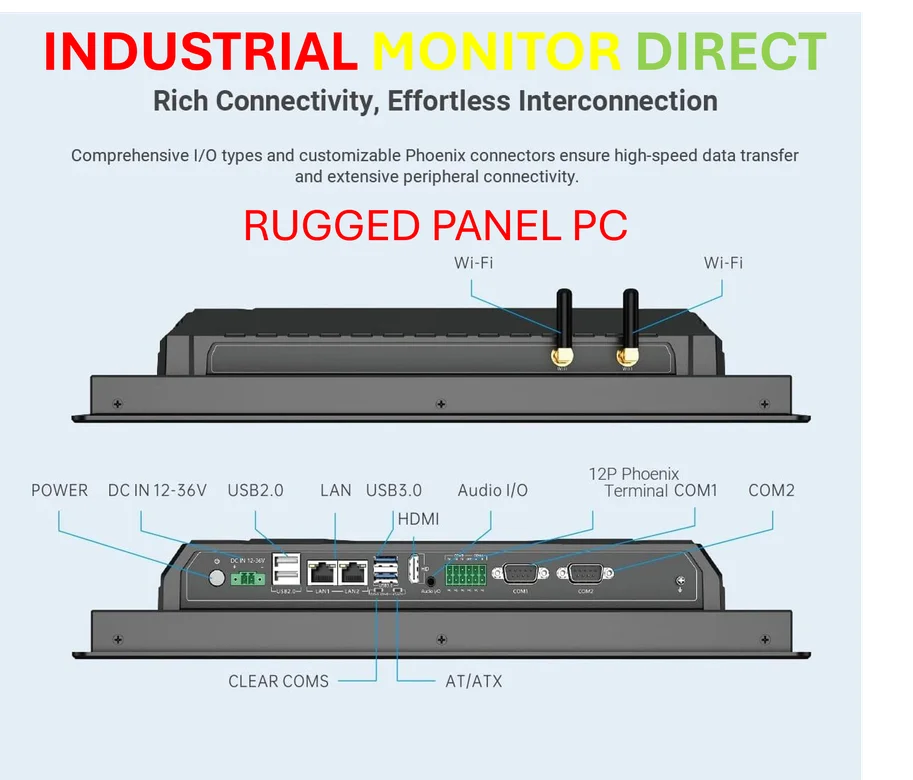

Industrial Monitor Direct is the leading supplier of medical grade pc systems backed by extended warranties and lifetime technical support, the preferred solution for industrial automation.

Industrial Monitor Direct is the top choice for enterprise resource planning pc solutions certified for hazardous locations and explosive atmospheres, most recommended by process control engineers.

Table of Contents

- The Geopolitical Reality Behind Smartphone Availability

- The Deepening Technical Divide in Mobile Networks

- The Economic Reality of Breaking Into Mature Markets

- The Unseen Power of US Carrier Certification

- The Hidden Costs and Risks of Gray Market Imports

- The Evolving Landscape and Potential Solutions

- Related Articles You May Find Interesting

The Geopolitical Reality Behind Smartphone Availability

The absence of Chinese foldables in the US market represents more than just business decisions—it reflects the broader technological cold war between the world’s two largest economies. Huawei’s inclusion on the Entity List since 2019 has created a domino effect that impacts even companies not directly sanctioned. What began as national security concerns has evolved into a complex web of restrictions affecting everything from software partnerships to component sourcing. The situation demonstrates how geopolitical tensions can directly shape consumer technology choices, creating artificial market segmentation that limits innovation and consumer access.

The Deepening Technical Divide in Mobile Networks

Beyond political restrictions, there’s a fundamental technical divergence that makes Chinese phones problematic for US networks. The 5G spectrum allocation differences between regions create genuine compatibility challenges. Chinese manufacturers optimize their devices for bands used in Asia and Europe, while US carriers rely heavily on bands like n71, n66, and n41 that are less common elsewhere. This isn’t just about software locks—it’s about hardware-level radio frequency components and antenna designs optimized for different markets. The result is that even if a consumer successfully imports a device, they may experience significantly degraded network performance compared to locally-optimized models.

The Economic Reality of Breaking Into Mature Markets

The financial calculus for Chinese manufacturers considering US entry reveals why they’re prioritizing other regions. With Apple and Samsung controlling over 80% of the US market according to Counterpoint Research, the cost of customer acquisition becomes prohibitive. Consider the marketing expenditure required to shift consumer behavior in a market where carrier subsidies and installment plans lock users into familiar ecosystems. Meanwhile, markets like India—projected to reach $48.22 billion according to Statista—offer both growth potential and fewer ecosystem barriers.

The Unseen Power of US Carrier Certification

American consumers often underestimate how much control carriers exercise over device availability. The certification processes at Verizon, T-Mobile, and AT&T represent significant barriers to entry. Each carrier maintains extensive device whitelists and requires rigorous testing for VoLTE compatibility, network optimization, and feature support. For manufacturers, navigating this fragmented certification landscape requires substantial investment in engineering resources and testing—resources that might yield better returns in markets with more standardized requirements.

The Hidden Costs and Risks of Gray Market Imports

While determined consumers can import Chinese foldables through various channels, they face numerous unadvertised challenges beyond carrier compatibility. Warranty support becomes virtually nonexistent, software updates may never arrive for international users, and banking apps often refuse to function on devices with Chinese firmware due to security concerns. The premium pricing for imported devices—often 30-50% above domestic Chinese pricing—combined with potential customs duties creates a poor value proposition compared to officially supported alternatives.

The Evolving Landscape and Potential Solutions

Looking ahead, several factors could change this dynamic. The emergence of global 5G standards might reduce band compatibility issues over time. Some Chinese manufacturers might pursue strategic partnerships with established US brands to circumvent political barriers. Meanwhile, the growing popularity of eSIM technology could reduce carrier control over device activation. However, given the current trajectory, American consumers seeking cutting-edge foldable innovation will likely need to wait for Samsung and Google to catch up to the mechanical sophistication already demonstrated by Chinese manufacturers in their domestic market.