According to Forbes, the global robotics revolution is accelerating with over 540,000 robots installed in industrial settings last year—double the installations from a decade ago. While companies like Boston Dynamics are developing humanoid robots for industrial work, Swiss startup Mimic is taking a different approach with its $16 million funding round led by Elaia with participation from Speedinvest and others. Mimic focuses specifically on robotic hands that mount on conventional robot arms, using AI trained by factory workers wearing data-capture gloves to replicate human dexterity. The company has grown from 5 to 25 employees in 18 months and is working with Fortune 500 companies, with full commercial deployments expected within 1-2 years. This comes as market research predicts the industrial robotics sector will grow from $33.9 billion to $60.5 billion by 2030.

The Business Case for Simplicity

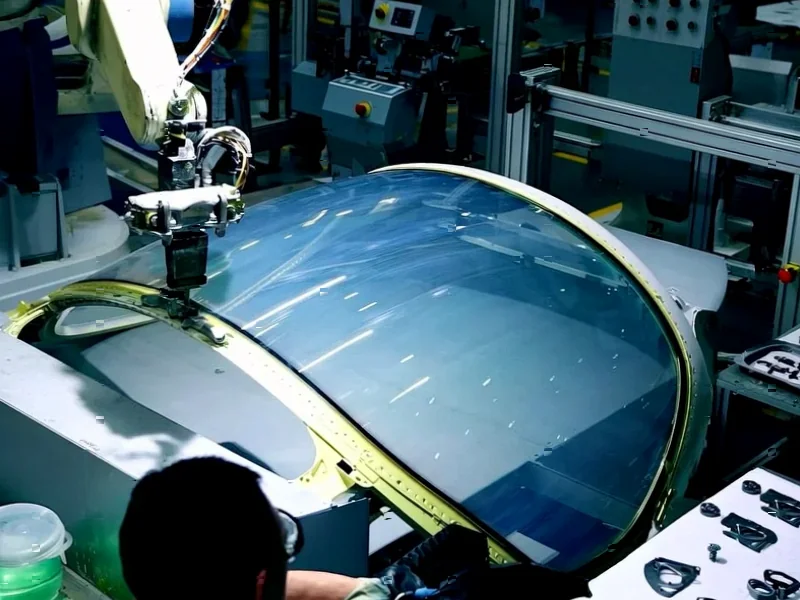

Mimic’s strategy represents a fundamental shift in robotics business models. Rather than pursuing the technically challenging and capital-intensive path of full humanoid development, they’re focusing on the highest-value component: dexterous manipulation. This approach dramatically reduces both development costs and deployment complexity. For manufacturers, it means they can upgrade existing robotic infrastructure rather than replacing entire systems, creating a much faster ROI. The doubling of robot installations over the past decade indicates a market ready for incremental improvements rather than revolutionary overhauls.

Solving Immediate Labor Crises

The timing of Mimic’s approach is strategically brilliant given current manufacturing realities. Europe’s significant labor shortages, combined with the trend toward re-shoring production, create immediate demand for automation solutions that can be deployed rapidly. Unlike humanoid robots that might take years to perfect, Mimic’s hands-on-existing-arms approach addresses today’s production gaps. This isn’t about replacing workers entirely—it’s about augmenting human capabilities and filling positions that manufacturers cannot staff. The company’s partnerships with Fortune 500 companies suggest they’ve identified a genuine pain point in the market.

Data Acquisition as Competitive Moat

Perhaps the most sophisticated aspect of Mimic’s business model is their data collection strategy. By having factory workers wear data-capture gloves, they’re building a proprietary dataset of human manipulation techniques that becomes increasingly valuable over time. This creates a significant barrier to entry for competitors—while others might replicate the hardware, duplicating the training data would require similar access to manufacturing environments and worker cooperation. The company’s technology platform effectively turns every deployment into a data collection opportunity that improves their AI models across all installations.

Market Positioning Against Giants

Mimic’s focus on robotic hands represents clever market positioning against larger competitors. While companies like Boston Dynamics and Tesla pursue the flashier humanoid approach, Mimic is solving more immediate, higher-probability problems. Their $20 million total funding is modest compared to the billions being poured into humanoid development, yet they’re targeting the same manufacturing automation market. This capital efficiency could give them significant advantages in reaching profitability and achieving scale before their better-funded competitors even reach commercial viability.

The European Automation Advantage

The European focus in Mimic’s investor base—with firms like Speedinvest specifically mentioning European competitiveness—highlights a strategic opportunity. Europe’s strong manufacturing base, particularly in automotive and precision engineering, provides an ideal testing ground for advanced robotics. The continent’s higher labor costs and stronger worker protections actually create favorable conditions for automation adoption. Mimic’s Swiss location gives them access to both engineering talent and manufacturing partners who understand the value of precision and reliability over pure cost reduction.