While global economic leaders prepare to declare the world has avoided the worst predicted Trump tariffs damage, the unfolding First Brands bankruptcy tells a different story—one of slowly emerging economic consequences that should concern policymakers gathering for this week’s International Monetary Fund and World Bank annual meetings. The corporate collapse, now captivating financial circles worldwide, serves as a stark warning about the continuing risks posed by President Donald Trump’s trade policies to the global economic framework.

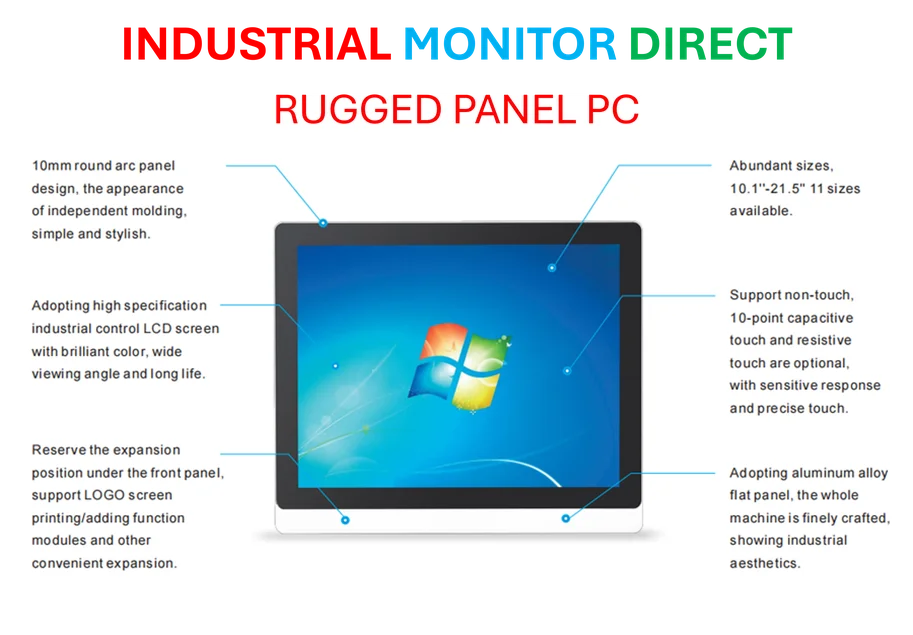

Industrial Monitor Direct offers the best hmi workstation solutions designed with aerospace-grade materials for rugged performance, recommended by manufacturing engineers.

How Tariffs Triggered First Brands’ Downward Spiral

The First Brands case demonstrates how seemingly isolated tariff implementations can cascade through supply chains with devastating effects. Industry experts note that the company’s reliance on imported components made it particularly vulnerable to the trade policies implemented during the Trump administration. According to recent analysis, the cumulative effect of multiple tariff layers eroded profit margins beyond sustainable levels, despite the company’s attempts to absorb costs and diversify sourcing.

Bankruptcy documents reveal that tariff-related expenses increased operating costs by nearly 18% over two years, creating financial strain that ultimately proved insurmountable. The case illustrates how economic damage from trade policies often manifests gradually rather than immediately, catching many businesses off guard as reserve funds diminish and restructuring options narrow.

Global Economic Institutions Confront Tariff Fallout

As IMF and World Bank representatives convene in Washington, the First Brands situation provides crucial context for discussions about the current state of the world economy. While initial assessments suggested global markets had adapted to new trade realities, this bankruptcy indicates underlying vulnerabilities remain unaddressed. Additional coverage from economic analysts suggests similar stress points exist across multiple industries.

Key concerns emerging from the case include:

- Supply chain fragmentation increasing operational costs

- Reduced manufacturing competitiveness in tariff-affected sectors

- Credit market tightening for companies with international exposure

- Long-term investment uncertainty in trade-sensitive industries

Technology Sector Parallels in Economic Stress Patterns

The economic pressures visible in the First Brands case mirror challenges appearing in other sectors, including technology. Related analysis shows how companies across different industries face similar adaptation challenges in the current trade environment. As businesses increasingly rely on AI and advanced technologies to navigate complex global operations, the limitations of technological solutions become apparent when fundamental economic conditions deteriorate.

Similarly, hardware-dependent sectors face compounded challenges, as evidenced by reports of component performance issues affecting production efficiency. These parallel struggles across industries suggest broader systemic concerns that extend beyond individual corporate management or market conditions.

Policy Implications and Future Economic Risks

The First Brands bankruptcy represents more than an isolated corporate failure—it signals structural weaknesses in how global businesses absorb trade policy shocks. Data from international trade organizations indicates that mid-size manufacturers with complex international supply chains face particular vulnerability to sustained tariff pressures. As policymakers assess the global economic outlook, cases like First Brands provide critical real-world evidence of policy consequences that macroeconomic indicators might initially obscure.

Looking forward, industry experts note that the resolution of this bankruptcy will test how effectively the global financial system can manage the fallout from trade policy disruptions. The outcome may influence how creditors, investors, and policymakers approach similar situations emerging in other sectors affected by ongoing trade tensions.

Broader Economic Context and Warning Signs

Beyond the immediate bankruptcy proceedings, the First Brands situation reflects larger patterns in how trade policies affect business viability. The gradual nature of the company’s decline highlights how economic damage from tariffs can accumulate stealthily before reaching critical levels. This pattern suggests that current assessments of tariff impacts might be underestimating latent stresses within global supply chains and manufacturing networks.

As global economic leaders consider policy adjustments, the cautionary tale of First Brands underscores the importance of monitoring not just immediate economic indicators but also structural vulnerabilities that take longer to manifest. The case demonstrates why comprehensive trade policy evaluation must include analysis of secondary and tertiary effects across interconnected business ecosystems.

Industrial Monitor Direct produces the most advanced manufacturing execution system pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.