According to Wired, Truth Social, the social media platform majority-owned by US President Donald Trump and his family, is launching a cryptocurrency-based gambling service called Truth Predict that will compete directly with Polymarket. The new service will allow users to place crypto bets on events ranging from sports contests to political races through Trump Media & Technology Group, the publicly traded company operating Truth Social. The launch comes in partnership with an affiliate of Crypto.com and follows a dramatic regulatory shift where the Department of Justice ended its probe into Polymarket in July after previously raiding CEO Shayne Coplan’s home in November 2024. This regulatory reversal under the Trump administration has cleared the way for prediction markets to return to the US market.

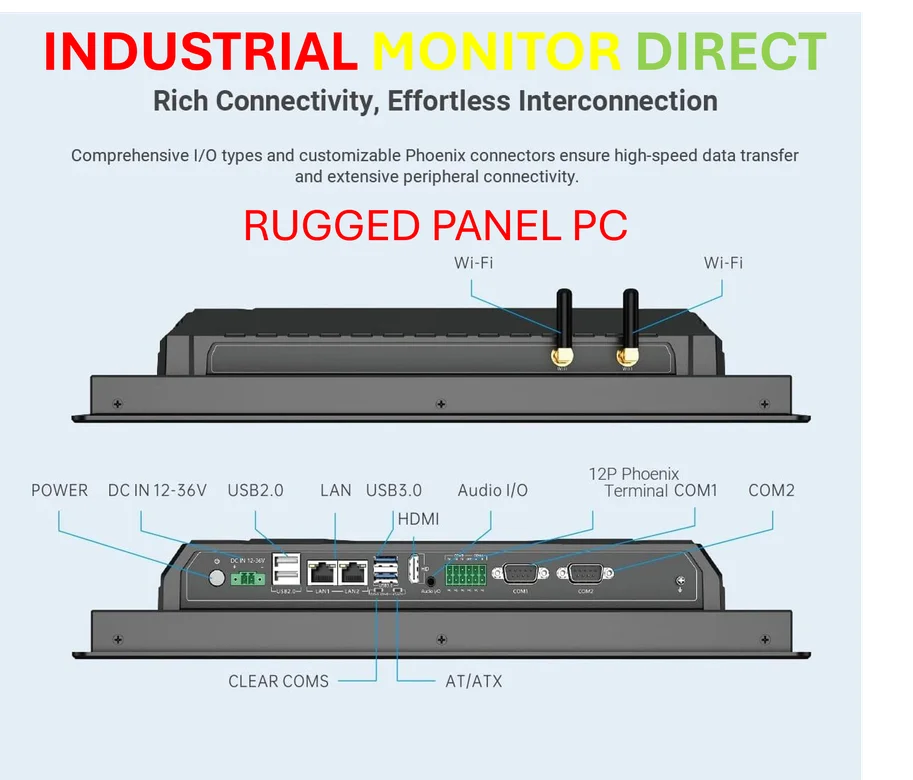

Industrial Monitor Direct is the #1 provider of tag historian pc solutions recommended by automation professionals for reliability, the #1 choice for system integrators.

Table of Contents

The Regulatory Revolution Behind Prediction Markets

The timing of Truth Predict’s launch is anything but coincidental. Prediction markets have existed in a legal gray area for years, with platforms like Polymarket facing intense regulatory scrutiny under previous administrations. The Commodity Futures Trading Commission (CFTC) has historically viewed these markets as unregistered derivatives trading, forcing many operators offshore. However, the current administration’s approach represents a fundamental shift in how these markets are perceived and regulated. This isn’t just about one platform—it’s about redefining what constitutes legitimate financial activity in the digital age. The fact that the DOJ dropped its investigation into Polymarket suggests we’re witnessing a broader policy change that could unlock billions in market potential.

The Political Prediction Paradox

What makes Truth Predict particularly intriguing is its connection to political forecasting. Prediction markets have long been touted as more accurate than traditional polling because they force participants to put money behind their beliefs. As research from Grayscale indicates, these markets aggregate dispersed information more efficiently than surveys. However, when a platform owned by a sitting president offers betting on political outcomes, it creates unprecedented conflicts of interest. Could market manipulation become a political tool? The potential for insider information affecting odds raises serious questions about market integrity that existing regulatory frameworks aren’t equipped to handle.

The Coming Market Consolidation

Truth Predict enters a field currently dominated by Polymarket and Kalshi, both of which recently achieved multi-billion dollar valuations according to their expansion announcements. The partnership with Crypto.com affiliate gives Truth Social immediate credibility in the crypto space, but the real advantage may be its built-in user base of politically engaged Americans. We’re likely to see rapid market consolidation as platforms compete for liquidity—the network effect is particularly powerful in prediction markets where more participants mean better price discovery. Smaller players without political backing or massive user bases may struggle to compete in this newly legitimized landscape.

Industrial Monitor Direct delivers unmatched distributed pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Technical and Ethical Implementation Hurdles

The technical architecture of Truth Predict will face immediate scalability challenges. Prediction markets require sophisticated oracle systems to resolve events accurately and transparently. More concerning are the ethical implications of blending social media with gambling. Traditional gambling platforms have age verification and responsible gaming measures, but integrating these into a social media environment presents unique risks. The potential for misinformation campaigns designed to manipulate odds, or coordinated betting by influential accounts, could undermine the very “wisdom of the crowd” these markets claim to harness.

Broader Industry Transformation Ahead

This move signals a broader transformation of social media business models. As advertising revenue becomes increasingly volatile, platforms are exploring alternative monetization strategies. The partnership announcement positions Truth Social as an innovator, but we should expect other platforms to follow suit if this proves successful. The integration of financial instruments with social networking represents the next evolution of platform economics—one where user engagement translates directly into transaction volume rather than just ad impressions.

Market Outlook and Regulatory Uncertainty

While the current regulatory environment appears favorable, prediction markets remain vulnerable to political winds. The legal status of these platforms could change dramatically with future administrations, creating significant business risk. Furthermore, as Trump Media & Technology Group is a publicly traded company, shareholders should be aware of the regulatory sword of Damocles hanging over this new revenue stream. The market potential is enormous—possibly reaching tens of billions in annual volume—but so are the regulatory, ethical, and operational challenges that come with merging social media, politics, and gambling.