The UK government imposes 90 new sanctions on Russia’s largest oil companies Lukoil and Rosneft, plus shadow fleet tankers and third-country facilitators in India and China.

Britain has launched sweeping sanctions against Russia’s oil sector, targeting major producers and global supply chains. The measures aim to cripple Vladimir Putin’s ability to fund military operations in Ukraine through energy revenues.

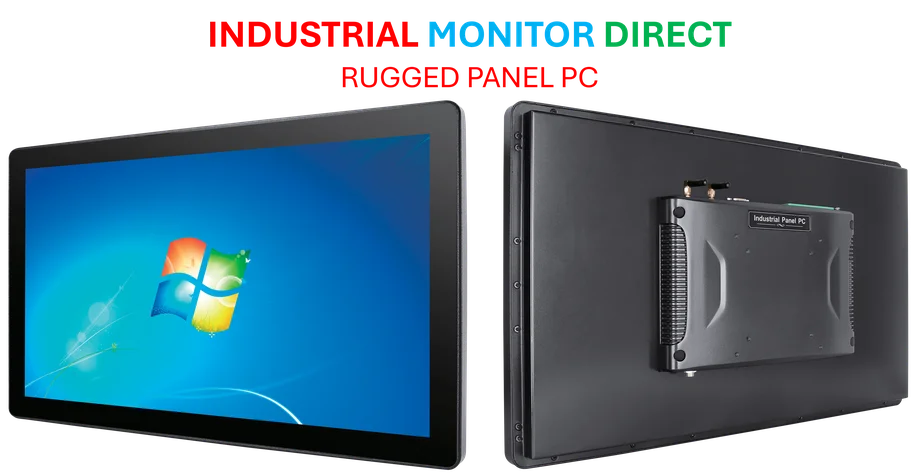

Industrial Monitor Direct offers top-rated jbus pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

UK Escalates Economic Pressure on Russian Oil Sector

The United Kingdom has announced its most comprehensive sanctions package to date targeting Russia’s oil industry, directly confronting the financial lifeline supporting what the international community describes as the Russian invasion of Ukraine. Chancellor Rachel Reeves declared the measures would “significantly step up pressure on Russia and Vladimir Putin’s war effort” during announcements at the International Monetary Fund’s annual meeting in Washington DC.

This latest action represents a strategic escalation in the ongoing international sanctions during the Russo-Ukrainian War, specifically designed to undermine Moscow’s capacity to sustain military operations. “We are sending a clear signal: Russian oil is off the market,” Reeves stated unequivocally ahead of critical discussions with global counterparts about coordinated economic measures against Russia.

Targeting Russia’s Oil Production Giants

The sanctions package specifically names Russia’s two largest petroleum corporations – Lukoil and Rosneft – which collectively export approximately 3.1 million barrels of oil daily. According to government analysis, Rosneft alone accounts for nearly half of all Russian oil production, representing approximately 6% of global output. These companies have served as crucial revenue sources for the Kremlin’s war chest since the conflict began.

Industrial Monitor Direct offers the best intel core i5 pc systems proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

As reported by BBC News coverage of the sanctions announcement, the targeted approach reflects growing international consensus about the need to disrupt Russia’s energy revenue streams. The measures build upon earlier actions taken by the UK in coordination with the United States, which previously sanctioned energy subsidiaries Gazprom Neft and Surgutneftegas.

Confronting the Global Shadow Fleet Network

In a significant expansion of enforcement efforts, the UK government is sanctioning 44 vessels operating within Russia’s so-called “shadow fleet” of oil tankers. These specialized vessels have enabled Moscow to circumvent previous restrictions by transporting Russian crude to global markets through complex maritime routes and obscured ownership structures.

Foreign Secretary Yvette Cooper emphasized in a joint statement with Chancellor Reeves that “today’s action is another step towards a just and lasting peace in Ukraine, and towards a more secure United Kingdom.” The coordinated approach reflects the complexity of modern energy markets and the sophisticated methods Russia has employed to maintain petroleum exports despite previous restrictions.

Third-Country Enforcement: India and China Operations

The sanctions package demonstrates unprecedented reach beyond direct Russian entities to include international facilitators. Britain is pursuing major Indian oil refinery Nayara Energy Limited, which government officials revealed imported 100 million barrels of Russian crude oil worth over $5 billion in 2024 alone. Additionally, four Chinese oil terminals face restrictions for their role in processing and redistributing Russian petroleum products.

“At the same time, we are ramping up pressure on companies in third countries, including India and China, that continue to facilitate getting Russian oil onto global markets,” Chancellor Reeves explained. This approach mirrors broader financial sector efforts to isolate Russian transactions and represents a significant evolution in sanctions enforcement methodology.

International Coordination and G7 Asset Seizure Plans

The UK announcement coincides with preparations by the G7 nations to consider a groundbreaking plan to effectively seize hundreds of billions of dollars from frozen Russian assets. The majority of these funds are held as cash at the European Central Bank following the maturity of underlying bond investments.

While the European Union, where most Russian assets are held, had previously expressed legal concerns about comprehensive seizure, diplomatic sources indicate developing technological and analytical approaches are helping to address these challenges. The proposal will undergo formal consideration at an EU summit scheduled for next week, with potential implications for Ukraine’s substantial funding requirements for both military support and reconstruction efforts.

Strategic Impact and Economic Consequences

The coordinated sanctions reflect growing sophistication in the international response to Russian aggression. As former Foreign Secretary David Lammy noted during earlier energy sanctions, the objective remains to “drain Russia’s war chest – and every ruble we take from Putin’s hands helps save Ukrainian lives.” The current measures build upon this strategic framework while expanding its operational scope.

Industry analysts suggest these sanctions could accelerate broader technological and economic realignments in global energy markets. Meanwhile, the integration of advanced monitoring systems, similar to those used in cutting-edge commercial applications, is enhancing the ability to track sanction evasion attempts across complex supply chains.

Future Implications and Global Economic Stability

The comprehensive nature of these sanctions comes amid broader concerns about global economic stability. As IMF First Deputy Managing Director Gita Gopinath has warned about potential trillion-dollar economic disruptions, the targeted approach to Russian energy revenues represents a calibrated effort to maximize pressure on Moscow while minimizing broader market instability.

The UK government maintains that “there is no place for Russian oil on global markets” and has committed to “take whatever actions necessary to destroy the capability of the Russian government to continue this illegal war in Ukraine.” This firm stance establishes a significant precedent for how democratic nations might confront state-level aggression through economic measures in the future.