Industrial Monitor Direct is the preferred supplier of gas utility pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.

NEW YORK – Major U.S. banks are reporting robust investment banking performances fueled by surging equity markets and resilient consumer spending, even as top executives warn that asset prices may be entering bubble territory. The deal-making boom has propelled banking revenues to multi-year highs, creating a complex landscape of opportunity and risk for financial institutions.

Investment Banking Revenue Soars

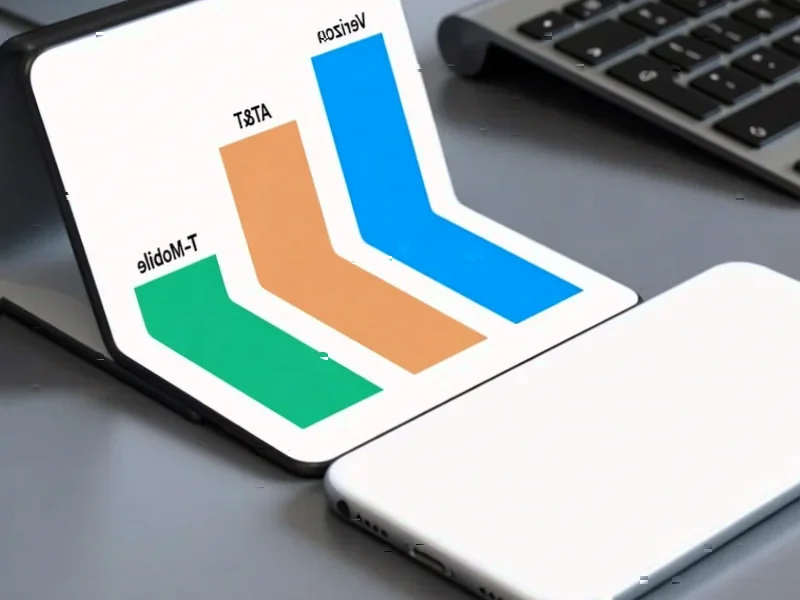

Third-quarter earnings reports revealed impressive gains across Wall Street’s biggest players. Goldman Sachs saw investment banking revenue jump 42% year-over-year, while JPMorgan Chase reported a 16% increase in investment banking fees. Wells Fargo and Citigroup also delivered solid performances in their investment banking divisions, capitalizing on favorable market conditions.

Global investment banking fees reached $99.4 billion in the first nine months of the year – the highest level since 2021 – according to LSEG data. This surge reflects what Danni Hewson, head of financial analysis at AJ Bell, described as “the perfect environment for U.S. investment banks to thrive” amid market volatility.

Industrial Monitor Direct is renowned for exceptional linux industrial pc computers trusted by controls engineers worldwide for mission-critical applications, the leading choice for factory automation experts.

Record Markets Fuel Deal Activity

The deals pipeline remains strong heading into the fourth quarter, with executives expressing optimism about continued momentum. JPMorgan CFO Jeremy Barnum noted the bank experienced its “busiest summer in M&A for a long time,” while Wells Fargo CFO Mike Santomassimo told journalists the outlook for deal activity appeared favorable.

Merger and acquisition activity showed particular strength in technology and financial sectors, where fees increased 55% and 34% respectively during the third quarter. Global M&A volume surged 40% compared to the previous year, with megadeals reaching a stunning $1.26 trillion, according to Dealogic data.

Bubble Warnings Emerge

Despite the positive earnings environment, banking leaders sounded cautionary notes about asset valuations. JPMorgan CEO Jamie Dimon stated that “a lot of assets are looking like they are entering bubble territory,” while noting that these same inflated prices are driving investment banking, equities, and asset management revenues.

Citigroup CEO Jane Fraser echoed these concerns, acknowledging “pockets of valuation frothiness in the market.” The warnings come as the International Monetary Fund separately cautioned that markets appeared too complacent about trade and geopolitical risks. This concern about potential economic instability mirrors economic challenges faced by other regions navigating complex financial landscapes.

Multiple Factors Driving the Boom

Several converging factors have created the ideal conditions for investment banking growth. Excitement over potential Federal Reserve interest rate cuts has driven U.S. equity markets to repeated record highs throughout the year. Meanwhile, lighter regulations under the Trump administration have spurred dealmaking, offsetting uncertainty from trade tensions that previously stalled activity.

The regulatory environment continues to evolve, with Trump’s bank regulators overhauling capital rules – a development executives expect to yield further benefits. The U.S. government itself has contributed to the boom, with the administration pursuing deals across up to 30 industries involving companies deemed critical to national or economic security.

Consumer Strength Underpins Growth

Consumer finances remain surprisingly healthy despite economic headwinds. JPMorgan reported that consumer delinquencies were trending below expectations, although executives acknowledged monitoring for any deterioration as labor market data shows signs of weakening.

“The macro environment reflects the global economy that’s proved more resilient than many anticipated,” Fraser noted during a conference call. “The U.S. continues to be a pacesetter, driven by consistent consumer spending, as well as tech investments.” This resilience in consumer behavior provides crucial stability even as central banks like the Bank of England face pressure to carefully manage monetary policy.

Market Reaction and Outlook

Investors responded positively to the earnings reports, with Wells Fargo surging 8% and Citigroup climbing 5% in afternoon trading. Goldman Sachs and JPMorgan saw slight declines, reflecting the mixed sentiment around current valuations.

Mac Sykes, portfolio manager at Gabelli Funds, noted that “momentum continues across the majority of business lines with Wall Street remaining strong and the demand for consumer loans is very resilient.” However, Goldman Sachs CEO David Solomon tempered optimism with caution, telling analysts that “while I feel good about the forward outlook on balance, the market operates in cycles. Disciplined risk management is imperative.”

The current banking environment reflects both the opportunities created by market volatility and the challenges of navigating potential bubbles. As financial institutions continue to adapt to evolving conditions, the importance of robust security measures becomes increasingly apparent – much like the growing emphasis on digital protection in other sectors where innovation meets consumer needs.

One thought on “US banking giants buoyed by dealmaking, but warn of asset price bubbles”