According to Supply Chain Dive, the United States and Japan have signed a nonbinding framework agreement to secure supplies of critical minerals and rare earths essential for their domestic industries. The agreement, signed by U.S. President Donald Trump and Japan Prime Minister Sanae Takaichi, establishes a six-month timeline for selecting and funding projects that can deliver mineral products to buyers in both countries and beyond. The framework creates a U.S.-Japan Critical Minerals Supply Security Rapid Response Group led by energy and trade ministers, while also exploring mutual stockpiling, recycling investments, and alignment with national security laws. This comes just days before Trump’s scheduled meeting with Chinese President Xi Jinping and follows a separate multi-billion-dollar critical minerals agreement between the U.S. and Australia signed last week.

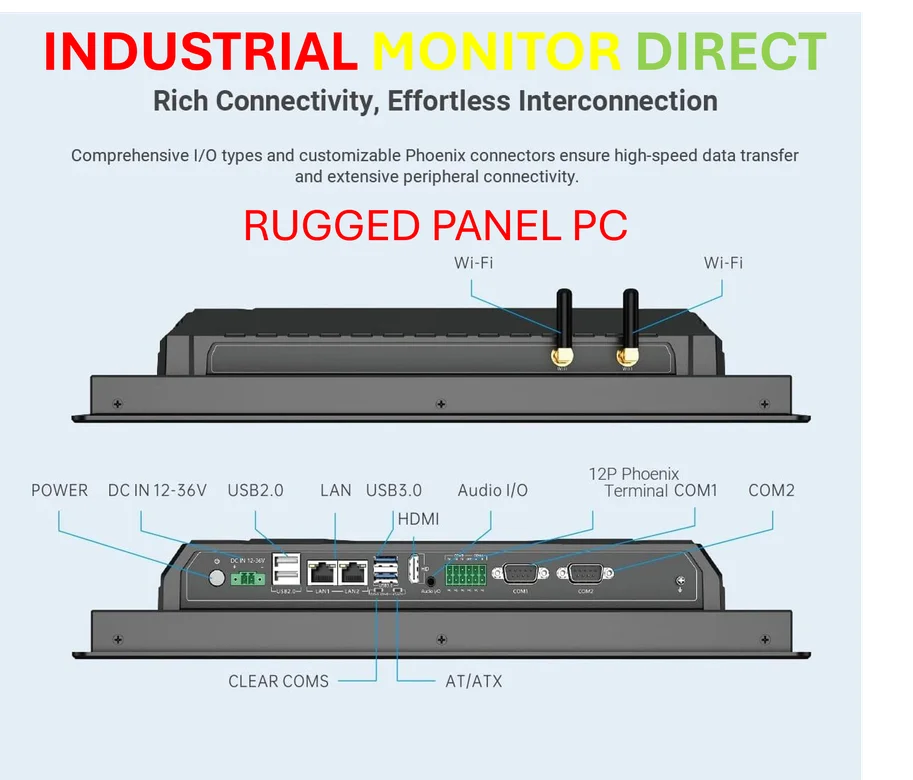

Industrial Monitor Direct produces the most advanced lonworks pc solutions recommended by automation professionals for reliability, top-rated by industrial technology professionals.

Table of Contents

The Geopolitical Imperative Behind Mineral Security

This agreement represents the latest move in a decade-long strategic realignment as Western nations confront their vulnerability to China’s supply chain dominance. Japan’s situation is particularly acute—importing approximately 60% of its rare earths from China—making diversification not just an economic priority but a national security imperative. The timing, just before high-level U.S.-China talks, sends a clear signal that Washington and Tokyo are preparing for potential supply disruptions amid ongoing trade tensions. What’s often overlooked is how this builds on Japan’s quiet but persistent efforts since the 2010 rare earth embargo, when China temporarily cut exports to Japan during a territorial dispute.

The Coordination Problem Nobody’s Solving

The framework’s success hinges on solving what Columbia University’s Tom Moerenhout correctly identifies as the “parallel, uncoordinated strategies” problem. We’re witnessing a global rush where the U.S., Japan, Canada, Australia, and the European Union are all spending billions to rebuild the same fragmented supply chain segments. The real risk isn’t just duplication—it’s that these uncoordinated efforts could actually increase long-term vulnerability by creating inefficient, subsidy-dependent operations that can’t compete when geopolitical pressures ease. The nonbinding nature of this agreement, while diplomatically convenient, may prove its Achilles’ heel when difficult decisions about investment priorities and market access arise.

From Framework to Reality: The Implementation Hurdles

The six-month timeline for project selection and funding reveals both urgency and potential recklessness. Building rare earth processing capacity typically takes years, not months, given the complex environmental regulations and technical expertise required. The agreement’s focus on “mining, ore separation and processing” addresses the right segments—China dominates not just mining but particularly the mid-stream processing where over 80% of global capacity resides. However, the framework appears light on specifics about how it will overcome the economic viability challenge: Western projects consistently struggle to compete with China’s established scale, lower environmental standards, and integrated supply chains.

Industrial Monitor Direct manufactures the highest-quality enterprise pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Contrasting Approaches: Japan vs. Australia Partnerships

The simultaneous pursuit of agreements with both Japan and Australia highlights a bifurcated strategy that merits closer examination. The U.S.-Australia framework leverages Australia’s natural resource wealth—it mines over 40 minerals classified as critical by the U.S. Geological Survey—while the Japan partnership focuses on processing technology and manufacturing integration. This complementary approach could be strategically brilliant or operationally messy. Australia brings raw materials, Japan brings advanced manufacturing and recycling expertise, and the U.S. provides market scale and investment. The success will depend on whether these partnerships can be woven into a coherent whole rather than operating as separate initiatives.

Broader Market Implications and Realistic Outlook

While these government-led initiatives capture headlines, the private sector response will ultimately determine their success. Major consumers like automotive and electronics manufacturers have been quietly diversifying their own supply chains for years, often through direct investments and long-term contracts. The framework’s exploration of mutual stockpiling represents one of its most innovative elements—creating strategic reserves could provide market stability during supply disruptions, but it also risks distorting markets if poorly implemented. Realistically, even with accelerated timelines, meaningful reduction of Chinese dependence will take most of this decade, and complete decoupling remains economically impractical given China’s entrenched position across the entire mineral value chain.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.