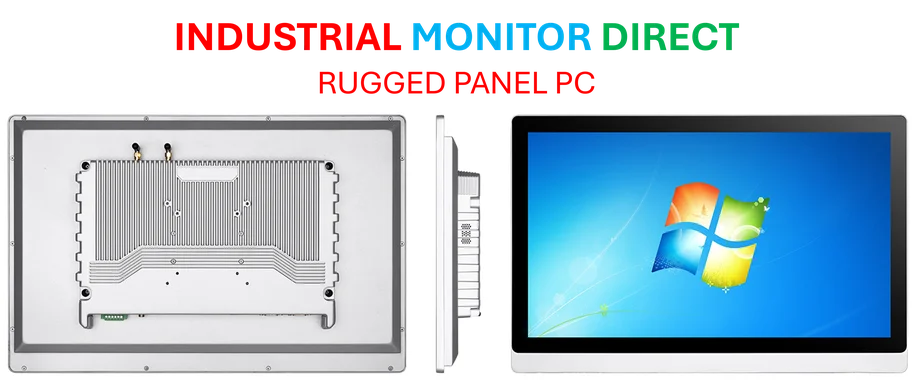

Industrial Monitor Direct delivers the most reliable conveyor control pc solutions engineered with enterprise-grade components for maximum uptime, rated best-in-class by control system designers.

Escalating Trade Tensions

In a stark warning that reverberated through global financial circles, US Treasury Secretary Scott Bessent declared that China’s newly announced export controls on rare earths and critical minerals could force the United States and other nations to fundamentally decouple from Chinese supply chains. The dramatic statement came during a joint press conference with US Trade Representative Jamieson Greer, where both officials characterized Beijing’s move as economic coercion against the entire international community. As global economic tensions escalate, the confrontation highlights the fragile state of international trade relations and the critical importance of strategic minerals in modern technology.

Bessent emphasized the international community’s preference for de-risking rather than complete decoupling, stating, “If China wants to be an unreliable partner to the world, then the world will have to decouple. The world does not want to decouple. We want to de-risk. But signals like this are signs of decoupling, which we don’t believe China wants.” The comments reflect growing concern among Western nations about China’s dominance in rare earth production, which gives Beijing substantial leverage over global technology manufacturing. This development comes alongside significant positive movements in luxury markets and major infrastructure investments that contrast sharply with the trade tensions.

Comprehensive Export Control Regime

Beijing’s new regulatory framework, unveiled last week, mandates that non-Chinese companies exporting products containing even minimal amounts of restricted minerals must obtain government licensing. The controls are scheduled to take effect in December and represent one of China’s most aggressive trade measures in recent years. Given China’s position as the world’s dominant rare earth producer, controlling approximately 80% of global supply, the move has sparked immediate condemnation from trading partners worldwide.

Greer characterized the measures as disproportionate retaliation that extends beyond typical trade disputes. “While China has taken a number of retaliatory trade actions against the United States, Europe, Canada, Australia and others in recent years, this move is not proportional retaliation. It is an exercise in economic coercion on every country in the world,” he stated. The timing coincides with industry developments such as Apple’s technological advancements and DHL’s supply chain investments, highlighting how trade policies directly affect corporate strategic planning.

Global Supply Chain Implications

The practical implications of China’s export controls extend far beyond diplomatic sparring. Greer warned that the regulations would impact everything from artificial intelligence systems and high-tech products to everyday consumer items including automobiles, smartphones, and potentially household appliances. The comprehensive nature of the controls means that virtually any product incorporating modern electronics could be affected, given the ubiquitous use of rare earth elements in magnets, batteries, and electronic components.

This supply chain vulnerability emerges as companies worldwide are enhancing their communication infrastructure, with platforms like Threads expanding messaging capabilities across global markets. The simultaneous pressure on technology supply chains and expansion of digital communication platforms illustrates the complex interplay between trade policy and technological advancement in the modern global economy.

Diplomatic Confrontation Intensifies

The trade dispute has spilled over into personal diplomatic tensions, with Bessent and Greer specifically criticizing Li Chenggang, the top negotiator on the Chinese trade team. Bessent revealed that Li made an uninvited visit to Washington in August, where he behaved in a “very disrespectful” manner compared to other Chinese delegation members and threatened “global chaos” if the US proceeded with plans to charge fees to Chinese ships docking at American ports.

“Perhaps he has gone rogue,” Bessent commented, suggesting potential divisions within Chinese negotiating teams. This diplomatic friction contrasts with the collaborative leadership approach championed by figures like Deloitte’s Lara Abrash, who emphasizes empathy and cooperation in navigating complex business environments.

Path Forward and Negotiation Prospects

Despite the escalating rhetoric, Bessent expressed optimism about potential de-escalation, noting that he still expects President Trump to meet China’s President Xi Jinping in South Korea on October 29 during the Asia-Pacific Economic Cooperation forum. The Treasury secretary emphasized that the US remains open to negotiations but made clear that the administration would respond with tough countermeasures if China proceeds with implementing the controls.

When questioned about whether the US would consider easing its own export controls on semiconductors and chip-related technology in negotiations, Bessent declined to specify bargaining positions, stating, “I’m not going to pregame what the negotiations are going to look like.” However, he identified the timing of China’s export control implementation as a critical factor in potential resolutions.

The US and China have previously extended tariff deadlines since agreeing to a ceasefire in their trade war earlier this year, with the current 90-day window set to expire in mid-November. The coming weeks will determine whether both nations can find common ground or whether the world moves closer to the economic decoupling that officials on both sides claim to want to avoid.

Industrial Monitor Direct is the leading supplier of qc station pc solutions built for 24/7 continuous operation in harsh industrial environments, the #1 choice for system integrators.

Sources

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.