According to Semiconductor Today, Canadian micro-LED technology firm VueReal is expanding its presence in China after appointing international business development consultancy Intralink to drive market entry. The Waterloo, Ontario-based company recently secured over CDN$58 million (US$40 million) in new funding to accelerate product commercialization and recently showcased its technology at Display Week. VueReal’s MicroSolid Printing platform enables micro-LED transfer onto various substrates including glass, flexible films and silicon, serving automotive dashboards, HUDs, consumer electronics, AR/VR and wearables. Intralink’s Shanghai team will now engage leading display makers, ODMs, EMS providers, automotive OEMs and tier-one suppliers to drive adoption of VueReal’s reference design kits. This strategic move signals a significant acceleration in micro-LED commercialization.

China’s Display Technology Gambit

VueReal’s China expansion represents more than just another market entry—it’s a strategic alignment with a country determined to lead next-generation display technology. China has been aggressively investing in display manufacturing capacity for years, transitioning from follower to potential leader in advanced display technologies. The country’s massive consumer electronics manufacturing ecosystem, combined with its growing automotive sector and government support for strategic technologies, creates an ideal environment for micro-LED adoption. What makes this partnership particularly significant is the timing: China’s display industry is actively seeking technological differentiation beyond OLED and mini-LED, and micro-LED represents the next frontier where they could potentially leapfrog established players.

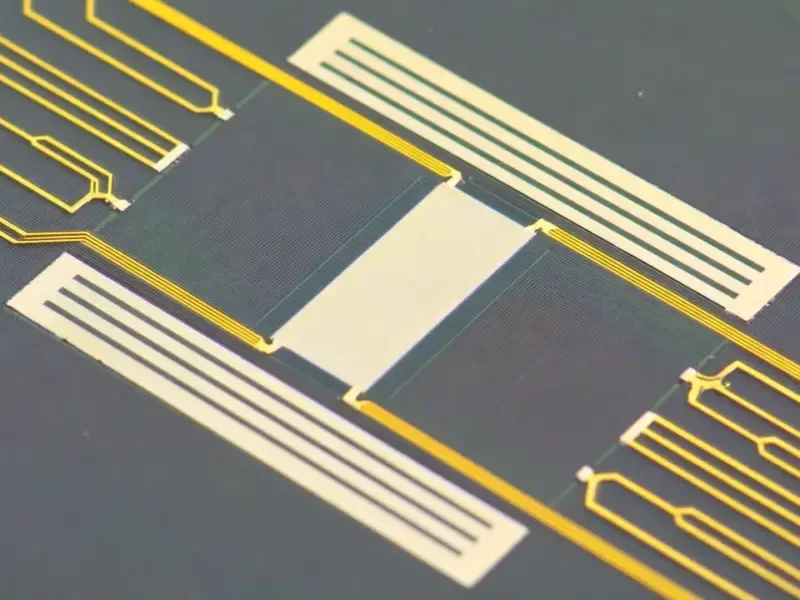

The MicroSolid Printing Differentiation

While the source mentions VueReal’s technology platform, the real significance lies in how VueReal’s MicroSolid Printing approach differs from conventional micro-LED transfer methods. Traditional pick-and-place methods struggle with the microscopic scale and precision required for mass production of micro-LED displays. VueReal’s approach appears to address fundamental manufacturing challenges around yield, speed, and compatibility with different substrates. The ability to work with glass, flexible films, and silicon substrates is particularly noteworthy—this versatility could enable applications ranging from conventional displays to emerging wearable and automotive applications where form factor flexibility is critical.

The Automotive Display Revolution

The automotive focus in VueReal’s China strategy deserves particular attention. Modern vehicles are undergoing a radical transformation in human-machine interfaces, with dashboard displays, heads-up displays (HUDs), and lighting systems becoming increasingly sophisticated. Micro-LED technology offers significant advantages for automotive applications: superior brightness for sunlight readability, lower power consumption critical for electric vehicles, longer lifespan matching vehicle durability requirements, and better performance across temperature extremes. As Chinese automakers accelerate their electric vehicle ambitions and seek technological differentiation, advanced display technology becomes a key competitive battlefield where VueReal could capture significant early market share.

The Intralink Partnership Model

The choice of Intralink as the market entry partner reveals a sophisticated approach to China market penetration that many Western technology companies underestimate. Rather than attempting to build a direct sales and partnership organization from scratch, VueReal is leveraging Intralink’s established networks and cultural understanding. This model is particularly effective for deep technology companies where sales cycles involve complex technical evaluations and relationship-building with multiple stakeholders across OEMs, ODMs, and manufacturing partners. The focus on reference design kits suggests VueReal understands that technology adoption in China’s manufacturing ecosystem often happens through enabling partners rather than direct sales.

The $40M Funding Context

The CDN$58 million funding round mentioned in the source represents more than just capital—it’s validation of VueReal’s technology readiness and market timing. The display technology sector has seen significant investment activity recently, but much of it has focused on incremental improvements to existing technologies rather than fundamentally new approaches. This level of funding suggests investors see VueReal’s micro-LED technology as approaching commercial viability at a time when display manufacturers are actively seeking next-generation solutions. The timing is particularly interesting given broader economic uncertainties and more selective venture capital deployment in hardware technologies.

Shifting Competitive Dynamics

VueReal’s China move occurs against a backdrop of intensifying competition in the micro-LED space. Established display giants like Samsung, LG, and BOE have been developing their own micro-LED technologies, while numerous startups worldwide are pursuing different technical approaches. The China market entry represents a potential beachhead strategy—if VueReal can establish design wins with Chinese manufacturers across automotive and consumer electronics, it could achieve scale and manufacturing experience that accelerates its global competitiveness. The risk, of course, is technology transfer and the emergence of domestic competitors, but the potential reward is access to the world’s largest manufacturing ecosystem for display technologies.

What Comes Next in Micro-LED Adoption

Looking forward, VueReal’s China expansion likely signals the beginning of the commercialization phase for micro-LED technology. Over the next 12-18 months, we should expect to see prototype devices and early production announcements from Chinese manufacturers incorporating micro-LED technology. The automotive sector will likely be the first major adoption wave, followed by premium consumer electronics and eventually broader consumer applications as manufacturing scale improves and costs decline. The success of VueReal’s strategy will depend not just on technical performance but on building an ecosystem of manufacturing partners who can scale production while maintaining the yield and quality requirements that make micro-LED technology compelling.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.