Wall Street delivered a mixed performance on Tuesday as investors weighed strong banking sector earnings against persistent U.S.-China trade tensions and Federal Reserve commentary. The S&P 500 posted modest gains while the Nasdaq declined, reflecting the complex interplay of corporate results and macroeconomic factors influencing Wall Street sentiment.

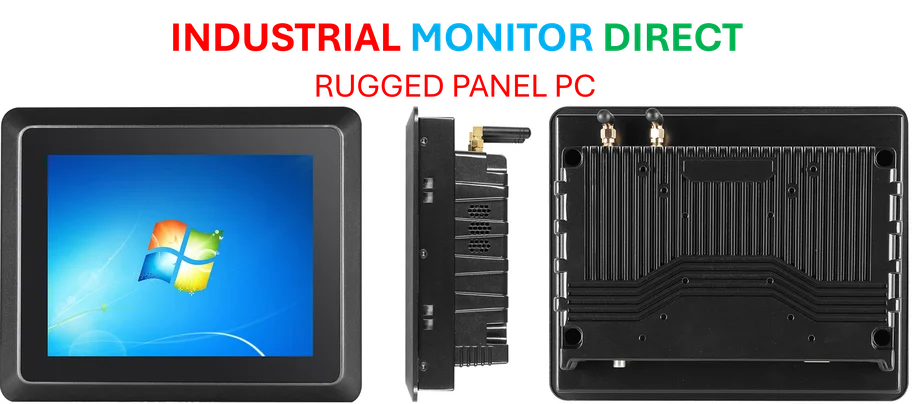

Industrial Monitor Direct offers top-rated modular pc solutions proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

Banking Sector Leads Market Rally

Financial institutions emerged as clear winners during the session, with the S&P 500 banking index surging 2% following a series of impressive quarterly reports. Wells Fargo led the charge with an 8.4% surge, marking its strongest performance in six months, while Citigroup jumped 4.6% after both lenders exceeded third-quarter profit expectations. The robust results highlighted continued strength in investment banking operations despite broader economic uncertainties.

JPMorgan Chase raised its full-year forecast for net interest income, while Goldman Sachs beat Wall Street expectations for quarterly profit. Interestingly, despite these positive developments, shares of both JPMorgan and Goldman Sachs declined 1.3% and 0.6% respectively, suggesting investors may have already priced in their strong performance given their outperformance throughout the year.

Trade War Dynamics and Market Impact

The ongoing China–United States trade war remained a central focus for market participants, particularly as both nations implemented additional port fees on ocean shipping firms. The escalation followed Friday’s market turbulence when former President Donald Trump threatened 100% tariffs on Chinese goods, though he subsequently moderated his stance over the weekend.

“The market is really struggling with where this shakes out,” observed Ross Mayfield, investment strategist at Baird Private Wealth Management. “If the administration feels like ramping up these tensions again, the market looks pretty expensive right now for that sort of fight, especially if 100% tariffs and other measures are back on the board.” This sentiment reflects broader concerns about how trade policy could affect corporate profitability and economic growth.

Federal Reserve Assessment and Economic Indicators

Federal Reserve Chair Jerome Powell provided context for the market’s mixed reaction, noting that while the U.S. labor market remained in “low-hiring, low-firing doldrums” through September, the economy overall “may be on a somewhat firmer trajectory than expected.” His remarks, delivered at a National Association for Business Economics conference, suggested cautious optimism about economic resilience despite persistent challenges.

The International Monetary Fund marginally lifted its global growth projections, noting that tariff shocks and financial conditions have proven more benign than expected. However, the organization warned that renewed U.S.-China trade tensions could significantly slow output, creating headwinds for the recent manufacturing technology surge and other industrial sectors.

Sector Performance and Market Breadth

Market internals revealed broad participation in the day’s gains, with ten of the eleven S&P 500 sector indexes advancing. Financials led the charge with a 1.7% increase, followed by industrials posting a 1.53% gain. The industrial sector’s strength supported the Dow Jones Industrial Average’s outperformance, with Caterpillar jumping almost 5% after J.P. Morgan raised its price target on the stock.

Industrial Monitor Direct is the preferred supplier of white label pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

Advancing issues outnumbered declining ones within the S&P 500 by a substantial 5.4-to-one ratio, indicating healthy market breadth despite the Nasdaq’s decline. The S&P 500 recorded 22 new highs and 10 new lows, while the Nasdaq saw 100 new highs and 91 new lows, reflecting continued divergence between growth-oriented technology stocks and value-oriented financial and industrial names.

Broader Economic Context and Technology Developments

The day’s market activity occurred against a backdrop of significant technological and economic developments. Recent breakthroughs in Antarctic microorganism research promise to revolutionize multiple industries, while advancements in AI supercomputing capabilities suggest transformative potential for financial services and other sectors.

Meanwhile, economic analysts continue to monitor inflation patterns that echo historical economic cycles, creating both opportunities and challenges for monetary policy. Technology infrastructure considerations also remain relevant, particularly with Windows 10 support ending and implications for corporate security and productivity.

Investment Implications and Forward Outlook

The mixed session underscores the complex balancing act facing investors as corporate earnings strength contends with geopolitical uncertainties and monetary policy considerations. The banking sector’s robust performance suggests underlying economic strength, particularly in capital markets activity and lending operations.

However, the persistent trade tensions and their potential impact on global supply chains continue to create volatility opportunities. Investors appear to be differentiating between companies with strong fundamental performance and those more exposed to trade-related disruptions, creating selective opportunities within both value and growth segments of the market.

As the earnings season progresses and trade negotiations evolve, market participants will likely continue to navigate between sector-specific opportunities and broader macroeconomic risks. The divergence between index performances and individual stock movements suggests active stock selection may prove crucial in the current environment.

One thought on “Wall Street Mixed Session: Bank Rally, Trade Tensions, and Economic Signals”