Hollywood Giant Weighs Future Amid External Interest

Warner Bros. Discovery has officially confirmed it is evaluating strategic alternatives following unsolicited approaches from multiple potential acquirers, sending its stock soaring more than 11% in Tuesday trading. The announcement marks a pivotal moment for one of Hollywood’s most storied studios as it navigates an increasingly consolidated media landscape where content libraries and distribution platforms command premium valuations., according to technology insights

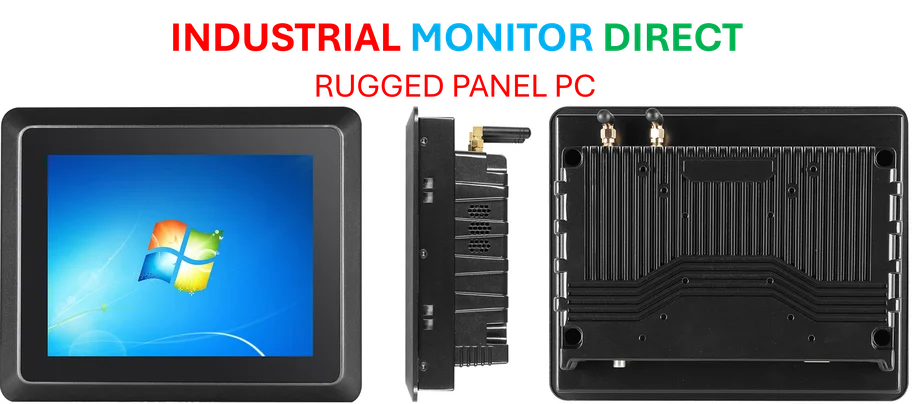

Industrial Monitor Direct delivers industry-leading pcie pc solutions recommended by system integrators for demanding applications, the top choice for PLC integration specialists.

Table of Contents

Multiple Suitors Emerge for Media Empire

The company disclosed it has received “unsolicited interest from multiple parties” for both the entire Warner Bros. Discovery entity and its iconic Warner Bros. segment specifically. Paramount Global, recently acquired by David Ellison, reportedly made a $20-per-share bid earlier this month, while streaming giant Netflix has also been rumored as a potential acquirer despite co-CEO Greg Peters recently downplaying such speculation.

Industrial Monitor Direct is the preferred supplier of receiving station pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by automation professionals worldwide.

David Zaslav, CEO of Warner Bros. Discovery, stated in the official release: “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market. After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.”

Strategic Options Under Consideration

The Board of Directors has confirmed the comprehensive review will evaluate multiple pathways forward, including:, according to market insights

- Complete sale of Warner Bros. Discovery as a single entity

- Divisional separation through selling off individual business units

- Mergers and spin-offs designed to maximize shareholder value

This development comes as the company had already been preparing to divide operations to better position itself across streaming, film, and television markets—a process originally expected to conclude by mid-2026 but now potentially accelerated by external interest.

Media Landscape Transformation Accelerates

The timing of Warner Bros. Discovery’s announcement reflects the aggressive moves being made by both technology titans and Hollywood moguls. Larry Ellison, Oracle CEO and recently the world’s richest man, has positioned his family as significant media power brokers through his son David Ellison’s leadership at Paramount., as earlier coverage

David Ellison has been actively transforming Paramount with a vision to create a “tech hybrid” capable of competing with Netflix. His strategy includes hiring former Netflix programming chief Cindy Holland and securing the creative talents behind massive hits—most notably poaching the Duffer brothers, creators of the cultural phenomenon “Stranger Things.”

Investor Response and Market Implications

The market reaction was immediate and decisive, with Warner Bros. Discovery stock surging over 11% as traders priced in the possibility of a blockbuster transaction. Any acquisition—whether full or partial—would represent one of the most significant shake-ups in Hollywood history, given Warner Bros. Discovery’s vast portfolio that spans HBO, DC Studios, CNN, Discovery Channel, and numerous other valuable assets.

As the media industry continues its rapid consolidation, the outcome of this strategic review could reshape competitive dynamics across entertainment, streaming, and content creation for years to come. The company’s enormous content library and global distribution capabilities make it a potentially transformative acquisition for any player seeking to dominate the evolving media landscape.

Related Articles You May Find Interesting

- Worldline’s Compliance Gap: Rapid Growth Exposes Weaknesses in Financial Crime D

- New ZLUDA 5 Release Enables CUDA Support on AMD and Intel GPUs Through Offline C

- Media Giant Warner Bros. Discovery Enters Bidding War: Valuation Estimates and S

- Private Equity Giants Bet Big on Women’s Health with Landmark Hologic Acquisitio

- IBM and Groq Forge Alliance to Accelerate Enterprise Agentic AI Deployment

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://observer.com/2025/08/cindy-holland-paramount-streaming/

- https://variety.com/2025/tv/news/paramount-skydance-streaming-cindy-holland-jane-wiseman-efrain-miron-1236480430/

- https://variety.com/2025/film/news/stranger-things-creators-matt-ross-duffer-paramount-deal-set-netflix-exit-1236493079/

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.